Highlights

- AI in financial services could unlock up to $1 trillion in value through automated processes and enhanced decision-making

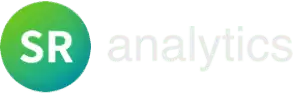

- Conversational AI reduces customer service costs by 30% while improving first-contact resolution rates by 20%

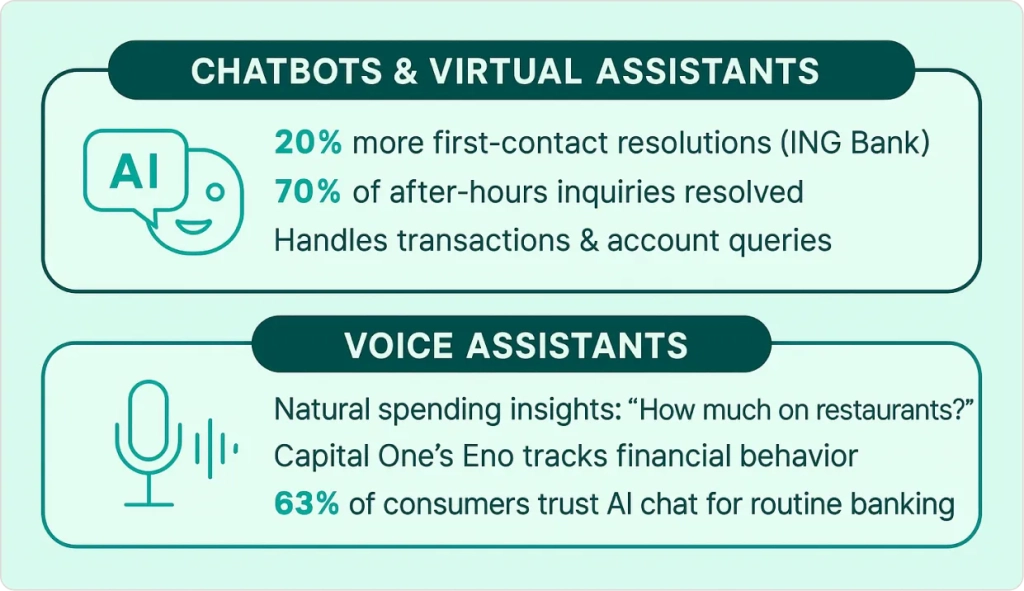

- Real-time fraud detection using AI can prevent 90% of fraudulent transactions with 300% better accuracy than traditional methods

- Agentic AI represents the next frontier, enabling autonomous agents to execute financial tasks without human intervention

- 83% of financial executives say AI differentiates their offerings and creates competitive advantages

- Implementation requires strategic planning, with typical ROI realization occurring within 12-24 months

Introduction

Five years ago, if you’d told me banks could approve a small business loan in less time than it takes to brew a pot of coffee, I would’ve laughed. Yet just last month, a regional bank president leaned across his desk and said, “We’ve gone from a three-day wait to approvals in under an hour. And get this—our default rates actually dropped.”

That’s not the future. That’s happening right now, thanks to AI.

But here’s the real story: the headlines always talk about speed and cost savings, but those are just table stakes. The bigger prize? According to McKinsey, banks stand to unlock up to $1 trillion with AI[1]. The catch? Only the ones that know how to make AI work for them will see those returns.

Over the past two years, I’ve been in the trenches with banks and fintechs trying to figure this out. I’ve watched organizations leap ahead—and I’ve seen some burn cash chasing shiny tech that solves nothing. The winners all have one thing in common: they know which AI use cases actually move the needle for their business.

This guide is your map to what works (and what doesn’t). From chatbots that make customers feel heard at 3 a.m. to new “agentic” AI tools that are just getting started, I’ll show you where the real transformation is happening in financial services. Whether you’re running a bank, a credit union, or a fintech startup, this is your shortcut past the buzzwords—and straight to results.

Conversational AI and Customer Experience

The most visible transformation in financial services AI starts the moment customers interact with your institution. Traditional customer service models—with their long hold times and limited availability—are becoming competitive disadvantages.

AI-Powered Chatbots and Virtual Assistants

Modern AI chatbots have moved far beyond simple FAQ responses. They’re now handling complex customer inquiries, processing transactions, and even providing personalized financial advice.

ING Bank’s generative AI chatbot improved first-contact resolution by 20%[2] by understanding context and providing detailed, accurate responses to customer questions about account balances, transaction history, and loan applications.

But here’s what makes these implementations successful: they’re designed to complement human agents, not replace them entirely. The AI handles routine inquiries while routing complex issues to specialists who can focus on high-value customer interactions.

One credit union client told me their AI assistant now handles 70% of after-hours inquiries that previously went unanswered until the next business day. “Our members love getting immediate help at 11 PM when they’re checking their accounts,” their operations manager explained.

Voice Assistants and Natural Language Processing

Voice-based financial services are gaining traction, particularly for routine banking tasks. Capital One’s “Eno” assistant helps customers track spending patterns and provides personalized insights through natural conversation.

The technology excels at understanding financial terminology and context. When a customer asks, “How much did I spend on restaurants last month?” the system can interpret this request, analyze transaction data, and provide detailed breakdowns without requiring specific command structures.

Research shows that 63% of consumers are comfortable with AI chatbots handling basic banking tasks, provided the interactions feel natural and secure.

For financial institutions considering conversational AI implementation, start with high-volume, routine inquiries where AI can provide immediate value while learning from customer interactions to improve over time. Our Power BI Consulting Services help design customer experience dashboards that track AI performance metrics and optimize these interactions based on real usage patterns.

Fraud Detection and Risk Management

Financial institutions lose billions annually to fraud, but AI is fundamentally changing how we detect and prevent these crimes. Traditional rule-based systems flag legitimate transactions as suspicious while missing sophisticated fraud schemes—a problem AI solves through pattern recognition and real-time analysis.

Real-Time Fraud Prevention

Modern AI fraud detection systems analyze hundreds of data points for each transaction in milliseconds. According to Mastercard’s research[3], their Decision Intelligence Pro has boosted fraud detection rates by 20-300% while reducing false positives that frustrate customers.

These systems consider transaction amount, location, time, merchant category, and historical customer behavior. But they also incorporate more sophisticated signals like device fingerprinting, network analysis, and even typing patterns for online transactions.

Credit Risk and Underwriting

AI is transforming how financial institutions assess creditworthiness by incorporating alternative data sources and adaptive modeling techniques. Traditional credit scoring relied heavily on credit history, but AI can evaluate loan applications using hundreds of additional factors.

Research from the Federal Reserve shows that machine learning models can extend credit access to underbanked populations while maintaining similar risk levels by analyzing non-traditional data sources like utility payments, rental history, and mobile phone usage patterns.

Benefits of AI-driven underwriting:

- Expanded access to credit for underbanked populations

- Faster loan approval processes (minutes instead of days)

- Reduced bias through data-driven decision making

- Continuous model improvement based on loan performance

- Better risk pricing for individual borrowers

Predictive Risk and Compliance Monitoring

Regulatory compliance in financial services requires constant monitoring of evolving requirements. AI systems can track regulatory changes, analyze their impact on current operations, and suggest necessary adjustments.

Citigroup uses AI to parse new regulations, recently analyzing 1,089 pages of new rules to identify specific compliance requirements and implementation deadlines. This automated analysis reduced compliance review time from weeks to hours.

One regional bank compliance officer shared with me: “AI doesn’t replace our judgment, but it gives us the complete picture much faster. We can focus on investigating genuinely suspicious patterns instead of manually reviewing thousands of routine transactions.”

For institutions looking to enhance their risk management capabilities, our Financial Services Analytics solutions help implement comprehensive monitoring systems that integrate fraud detection, credit risk assessment, and compliance management in unified dashboards.

Personalized Wealth and Investment Services

The wealth management industry is experiencing a democratization driven by AI. Technologies once available only to high-net-worth clients are now accessible to everyday investors through robo-advisors and AI-powered financial planning tools.

Robo-Advisors and Wealth Management

AI-driven portfolio management has matured beyond simple asset allocation. Modern systems provide personalized investment strategies based on individual goals, risk tolerance, and life circumstances.

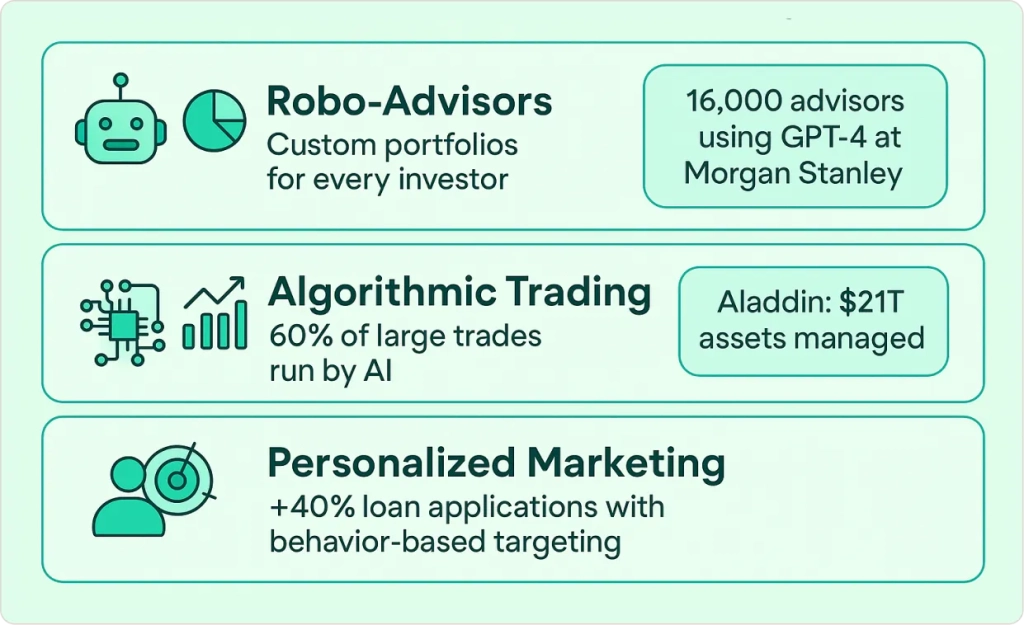

Morgan Stanley equipped 16,000 financial advisors with GPT-4-powered research assistants that analyze market conditions, client portfolios, and investment opportunities to provide real-time recommendations during client meetings.

But here’s what I find most interesting: the best AI wealth management platforms combine automated portfolio management with human oversight. They’re not replacing financial advisors—they’re making them more effective by handling routine tasks and providing better data for client conversations.

Algorithmic Trading and Market Analysis

According to industry research[4], 60% of trades over $10 million are now executed by algorithms, and AI is making these systems more sophisticated. Modern trading algorithms don’t just execute predefined strategies—they adapt to market conditions in real-time.

BlackRock’s Aladdin platform manages over $21 trillion in assets using AI to analyze risk, optimize portfolios, and execute trades across global markets. The system processes millions of data points daily to identify opportunities and manage risk exposure.

Personalized Marketing and Product Recommendations

Financial institutions are using AI to move beyond generic product marketing toward personalized financial guidance. Bank of America uses AI to deliver personalized investment advice and product recommendations based on customer financial behavior and goals.

One community bank president told me their AI-driven marketing increased loan applications by 40% simply by timing offers better. “Instead of sending generic promotions, we now offer home equity loans right after customers start researching home improvements online.”

For organizations looking to enhance their wealth management offerings, our AI-Powered Financial Analytics Solutions provide the foundation for personalized customer experiences while maintaining compliance and security standards.

Operational Automation and Document Intelligence

Back-office operations in financial services involve massive amounts of document processing, data entry, and routine tasks that are perfect candidates for AI automation. These applications often provide the fastest return on investment because they directly reduce operational costs while improving accuracy.

Automated Document Processing

Financial institutions process millions of documents annually—loan applications, insurance claims, compliance reports, and customer correspondence. AI-powered document intelligence transforms this manual work into automated workflows.

Google Cloud’s generative AI finds key information in financial policies and credit memos in seconds rather than hours, extracting relevant data points and flagging areas requiring human review.

A mortgage lender we worked with reduced loan processing time from five days to eight hours by automating document review. Their operations manager explained: “AI handles the routine document checking, so our underwriters can focus on complex cases that require human judgment.”

Key benefits of document automation:

- 90% reduction in manual data entry errors

- 70% faster processing times for routine applications

- 24/7 processing capability for time-sensitive documents

- Consistent application of business rules and compliance standards

Back-Office Task Automation

Robotic Process Automation (RPA) combined with AI is transforming repetitive financial processes. McKinsey research indicates that approximately 30% of financial services tasks are fully automatable.

One credit union reduced new account opening time from 45 minutes to 12 minutes by automating identity verification, credit checks, and initial funding. Customer satisfaction increased because the process became faster and more consistent.

Our Data Engineering Services help financial institutions build the robust, secure infrastructure necessary to support these AI-driven operational improvements while maintaining regulatory compliance and data governance standards

Emerging AI Trends: Generative and Agentic AI

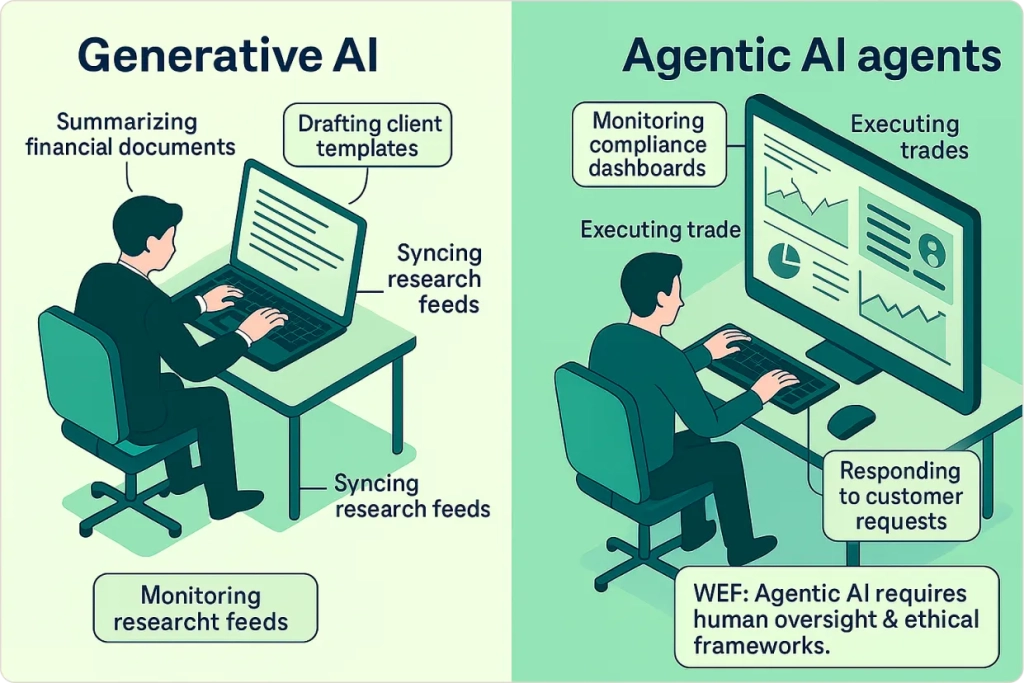

Generative AI excels at creating human-like content and summarizing complex information. Deutsche Bank and MSCI collaborated with Google Cloud[5] to pilot generative AI for financial document search and virtual assistant capabilities, reducing research time by 60% for their investment teams.

Generative AI applications:

- Personalized financial reports and investment summaries

- Regulatory compliance documentation

- Customer communication templates

- Market research synthesis from multiple sources

Agentic AI represents the most significant advancement in financial technology since online banking. These systems can independently perceive, reason, act, and learn without constant human supervision.

Citigroup’s research highlights emerging agentic use cases[6] including compliance monitoring, fraud detection, KYC processes, wealth management, and credit workflows. Their analysis suggests agentic AI will “turbocharge the ‘Do It For Me’ economy” by executing financial tasks autonomously.

Real-world agentic AI examples:

- Trading bots that research market conditions, develop strategies, and execute trades

- Compliance agents that monitor regulatory changes and update internal policies

- Customer service agents that handle end-to-end problem resolution

- Investment advisors that continuously rebalance portfolios based on market conditions

The potential is enormous, but implementation requires careful planning. World Economic Forum experts emphasize the need for human oversight, ethical guidelines, and robust governance frameworks.

For financial institutions exploring these emerging technologies, our Data Analytics Services provide the foundation for AI experimentation and implementation while maintaining security and compliance standards.

Implementation Strategy and Best Practices

Successfully implementing AI in financial services requires strategic planning and organizational change management. Start with business problems, not technology solutions. The most successful AI implementations address specific pain points that impact customer experience, operational efficiency, or competitive positioning.

One regional bank achieved 15% cost reduction in their lending operations within 18 months by focusing on loan processing automation rather than trying to implement every possible AI application simultaneously.

Key success factors:

- Identify high-volume, repetitive processes suitable for automation

- Evaluate data quality and availability for AI applications

- Assess team capabilities and training requirements

- Calculate potential ROI and implementation costs

Research shows that 50% of employees will need significant reskilling by 2025 as financial services become more technology-driven. Plan for significant training investment and expect productivity decreases during the learning curve.

Many successful implementations use a hybrid approach: partnering with specialized vendors for core AI platforms while building internal expertise for customization and optimization. Establish clear metrics before implementation to track processing time reduction, error rate improvement, customer satisfaction scores, and cost savings.

For strategic guidance on AI implementation in financial services, our Data Visualization Services create executive dashboards that track AI performance metrics and ROI, while our comprehensive consulting approach helps organizations develop AI roadmaps that align technology investments with business objectives.

Conclusion

AI in financial services has moved beyond experimental pilots to become a competitive necessity. Organizations that strategically implement these technologies gain significant advantages in customer experience, operational efficiency, and risk management.

The evidence is compelling: companies that make data-driven decisions are 23 times more likely to acquire customers, and AI applications like fraud detection, conversational customer service, and automated underwriting deliver measurable ROI within 12-24 months.

But success requires more than technology adoption. It demands strategic planning, organizational change management, and deep understanding of both AI capabilities and financial services requirements.

As agentic AI and generative applications continue evolving, financial institutions that build strong AI foundations today will be positioned to capitalize on tomorrow’s innovations. The question isn’t whether AI will transform your organization—it’s whether you’ll lead the transformation or struggle to catch up.