TL;DR:

- Private equity firms implementing structured data analytics achieve a 17% return premium over traditional financial-only analysis approaches

- The average mid-market fund wastes $2-5M annually on missed operational improvements and delayed exits due to poor portfolio visibility

- Modern PE data stacks reduce due diligence cycles from 6 weeks to under 2 weeks while improving accuracy from 75% to 99%

- This post provides a diagnostic framework to assess if your fund needs data analytics in private equity infrastructure upgrades and a 4-phase implementation roadmap with cost ranges

- Private equity firms managing $500M+ in AUM can implement enterprise-grade analytics for $300K-$600K in Year 1 using cloud-based platforms

Quick Answer

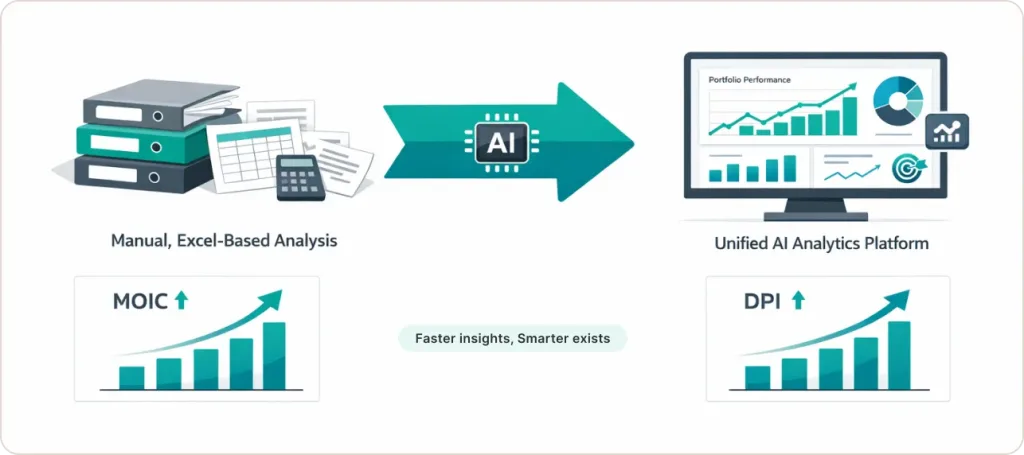

Private equity firms using modern data analytics platforms consolidate portfolio company financials, unstructured documents, and alternative data sources into unified systems that enable real-time monitoring, AI-powered due diligence, and predictive exit modeling, resulting in measurable improvements to MOIC and DPI metrics compared to manual Excel-based approaches.

How Do You Know If Your PE Firm Needs a Data Infrastructure Upgrade?

Your private equity firm needs data infrastructure investment when LP reporting takes more than 24 hours to compile, due diligence requires manual review of thousands of documents, or portfolio company performance surprises emerge 45+ days after problems begin.

Answer these five diagnostic questions honestly:

1. How long does it take to answer: “What’s our consolidated revenue across all portfolio companies this month?”

If the answer is more than 24 hours, you have a data consolidation problem. One $2.1B industrial fund took 8 days to compile this number across 14 portfolio companies because each used different ERP systems (NetSuite, SAP, QuickBooks) with no integration layer.

Cost of delay: Missing early warning signs of revenue decline means intervention happens 60-90 days late. By then, a correctable $200K problem becomes a $2M crisis.

2. Can your investment team ask complex questions across historical documents?

Modern vector search and RAG systems used by leading private equity firms can answer questions like “What were the specific reasons behind declining margins in our logistics investments during Q3 2023?” in under 5 minutes by analyzing every document in your data room.

If this requires manually re-reading 200 board decks, you’re leaving alpha on the table.

3. Do you know which portfolio companies are at risk before the quarterly board call?

In our analysis, firms with real-time private equity analytics monitoring capabilities resolve operational issues 3.2x faster than those relying on monthly reporting cycles.

4. Are you still manually copying data between systems?

A $3.5B healthcare-focused private equity firm spent $400K in audit preparation costs in 2023 because they couldn’t produce a clear data lineage trail across their portfolio.

5. Can you consolidate portfolio company data for LP reports in under 4 hours?

If your team spends 40+ hours per quarter manually compiling LP reports, you’re paying $80K-$120K annually in labor costs for work that modern private equity data analytics platforms automate in under 4 hours.

Scoring Your Diagnostic:

- 0-1 “Yes” answers: Critical data infrastructure gap—estimated annual cost: $2-5M

- 2-3 “Yes” answers: Moderate gaps—estimated annual cost: $500K-$1.5M

- 4-5 “Yes” answers: Strong foundation—focus on optimization, not overhaul

What Are Leading PE Firms Actually Building in Their Data Stacks?

Top private equity firms are implementing three integrated systems: AI-powered due diligence platforms that analyze 10,000+ documents in 72 hours, real-time portfolio monitoring dashboards connected to portfolio company ERPs, and predictive exit models using machine learning to optimize timing.

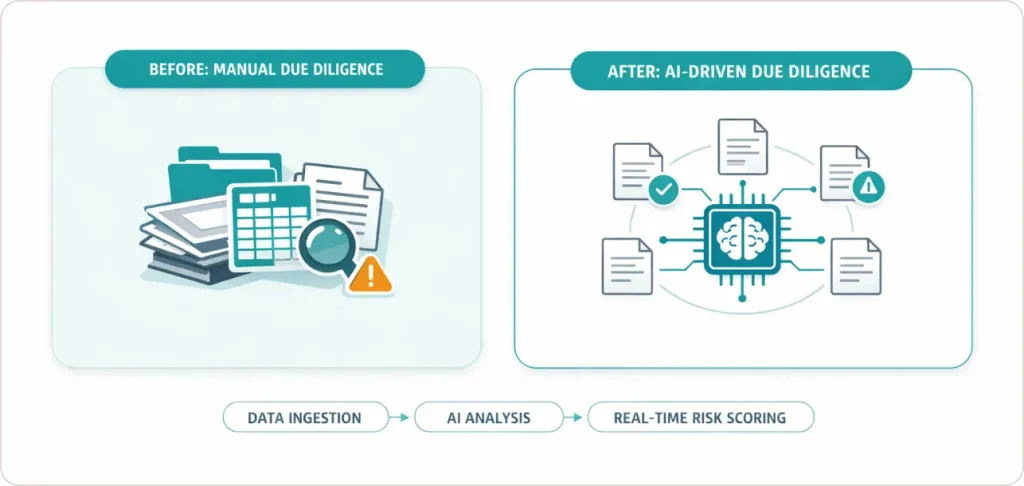

System 1: AI-Driven Due Diligence Infrastructure

Traditional Approach:

- 6-8 weeks to review 14,000 documents

- 3-4 associates working full-time

- 70-75% accuracy (the “30% accuracy gap” documented in Bain’s 2025 Global Private Equity Report)

- Cost: $180K-$250K

Modern AI-Augmented Approach:

- 72 hours for initial document classification

- 1-2 associates focus on AI-flagged high-risk items only

- 99% accuracy through human-in-the-loop validation

- Cost: $40K-$60K

Real Example: A $1.8B manufacturing-focused private equity firm used data analytics consulting services for natural language processing to analyze 14,000 vendor contracts, identifying $1.2M in hidden liabilities the seller hadn’t disclosed. Manual review would have taken 6 weeks and cost $180K.

System 2: Real-Time Portfolio Monitoring Platforms

Distributions to LPs as a percentage of NAV hit their lowest rate in over a decade in 2024, according to Bain’s Global Private Equity Report 2025. LPs now demand real-time transparency.

Implementation Reality: A $2.7B software-focused private equity firm implemented Snowflake + Tableau with API integrations, achieving ROI in Month 7 — similar to our work with Pinnacle Fund Services, where we delivered 360-degree fund performance insights across 15+ detailed reports.

System 3: Predictive Exit Modeling

According to Preqin’s research, private equity firms using predictive exit models achieve MOIC improvements of 0.3-0.5x compared to intuition-based timing. On a $100M exit, that’s $30-50M in additional value to LPs.

Why Has Data Analytics Become Non-Negotiable for PE Firms?

Data analytics in private equity became essential because the zero-interest-rate era ended, eliminating leverage-driven returns and forcing funds to generate alpha through operational improvements that require granular data visibility.

1. You Can’t Lever Your Way to Returns Anymore

With interest rates at 5-6%, private equity firms must mitigate operational and financial risks more aggressively — our fraud detection and risk management solutions help PE portfolios identify suspicious patterns, reduce compliance exposure, and protect deal valuations.

Concrete Example: A $950M food manufacturing portfolio company had $850,000 in working capital trapped in inefficient vendor payment terms. A data analytics private equity specialist analyzed transaction-level data and identified 23 vendors with unfavorable terms costing $71K monthly. The entire analysis took 4 hours.

2. Competitive Deal Processes Now Close in 45 Days

| Process | Manual Approach | AI-Augmented Approach | Time Saved |

|---|---|---|---|

| Contract Review | 6 weeks | 72 hours | 75% faster |

| Financial Model Building | 2 weeks | 3 days | 65% faster |

| Market Research Synthesis | 1 week | 2 days | 60% faster |

According to Analytics8, private equity firms implementing AI-driven due diligence reduce manpower requirements by 40% while improving accuracy.

3. Portfolio Monitoring Became a 24/7 Requirement

A $4.2B multi-sector private equity firm implemented a unified data lakehouse in early 2024. After implementation: 90% of LP questions are answered in under 2 hours using self-service dashboards, freeing up 400+ analyst hours per quarter.

What Tools Are Leading PE Firms Actually Using?

Leading private equity tools for the finance industry include PitchBook and Affinity for deal sourcing, Drooms and custom NLP platforms for due diligence, and Snowflake or Databricks data lakehouses for portfolio monitoring.

Category 1: Deal Sourcing and Market Intelligence

| Tool | Primary Use Case | Annual Cost | Implementation |

|---|---|---|---|

| PitchBook | Market data, comp analysis | $40K-$80K/seat | 2 weeks |

| Affinity | Relationship intelligence | $30K-$60K/year | 3-4 weeks |

| CB Insights | Technology trend tracking | $30K-$50K/year | 1 week |

Category 2: Due Diligence and Document Analysis

| Tool | Primary Use Case | Cost Per Deal | Timeline |

|---|---|---|---|

| Drooms/Intralinks | Secure VDR with AI classification | $15K-$40K | 1 week |

| Kira Systems | Automated contract review | $25K-$50K/year + $5K/deal | 2-3 weeks |

ROI Example: A $1.5B industrial private equity firm invested $120K to build a custom contract analysis system. They used it on 7 deals in 18 months, saving $40K per deal in legal review costs. Total ROI: $160K net benefit.

Category 3: Portfolio Monitoring Infrastructure

| Component | Solution | Year 1 Cost | Timeline |

|---|---|---|---|

| Data Lakehouse | Snowflake, Databricks, BigQuery | $80K-$200K | 12-16 weeks |

| BI/Visualization | Tableau, Power BI | $30K-$80K | 4-6 weeks |

| Governance | Unity Catalog | $50K-$150K | 6-8 weeks |

Total Year 1 Investment: $300K-$600K for a private equity firm managing $500M-$2B in AUM with 8-12 portfolio companies.

Private equity firms requiring embedded analytics for LP portals can leverage Power BI’s scalable architecture — we helped Beast Insights reduce manual reporting effort by 80% through embedded dashboards, a similar approach applicable to PE investor portals.

How Should PE Firms Build Their Data and Analytics Infrastructure? (4-Phase Roadmap)

Private equity firms should implement data infrastructure through a phased approach starting with data consolidation, followed by governance, self-service analytics, and advanced AI/ML capabilities.

Phase 1: Consolidate the Chaos (Months 1-4)

Objective: Get all data into one centralized platform.

Choose a cloud data lakehouse (Snowflake, Databricks, or BigQuery) and ingest:

- Portfolio company financials (NetSuite, SAP, QuickBooks)

- Operational metrics (Salesforce, HubSpot, Workday)

- Unstructured documents (board decks, contracts, due diligence reports)

- External data (PitchBook, news feeds, industry benchmarks)

Success Metrics:

- 80%+ of portfolio data flowing within 90 days

- LP report generation reduced from days to hours

- Ad-hoc questions answerable in under 4 hours

Typical Cost: $150K-$300K

Common Mistake: One $3B private equity firm spent $800K on a Snowflake warehouse for structured financial data only, then spent another $300K adding unstructured data capabilities. Start with a lakehouse that handles both from Day 1.

Phase 2: Implement Governance and Zero-Copy Sharing (Months 4-6)

Objective: Establish centralized security and audit trails.

Implement Unity Catalog or a similar governance layer. Use Delta Sharing or Microsoft Fabric for zero-copy data sharing—portfolio companies grant secure access to their data in place without manual exports.

According to Unity Catalog documentation, private equity firms using centralized governance reduce audit preparation time by 50-60%.

Typical Cost: $80K-$150K

Phase 3: Enable Self-Service Analytics (Months 6-9)

Objective: Allow non-technical users to query data without SQL knowledge.

Deploy natural language query tools (AI/BI Genie, Tableau Ask Data, Power BI Q&A).

Real Example: A $2.4B healthcare private equity firm implemented business intelligence consulting solutions with Databricks AI/BI Genie. Result: 70% of ad-hoc questions are now self-served by business users, freeing the data team to focus on predictive modeling instead of routine reports.

Typical Cost: $60K-$120K

Phase 4: Build Predictive Capabilities (Months 9-18)

Objective: Use machine learning to predict outcomes.

Advanced use cases:

- Predictive Exit Modeling: Which portfolio company is ready for exit?

- Operational Risk Scoring: Which companies will miss budget next quarter?

- Due Diligence Automation: AI agents that score acquisition targets

This phase requires either hiring 1-2 data scientists with PE domain expertise ($200K-$300K each annually) or partnering with a specialized consultancy ($150K-$400K annually).

ROI Justification: Per Preqin research, private equity firms using predictive models achieve 0.3-0.5x MOIC improvements. On a $100M exit, that’s $30-50M in additional LP value.

Typical Cost: $200K-$500K/year

What Are the Biggest Mistakes PE Firms Make with Data Investments?

The most common PE data mistakes include assuming AI solves everything without human validation, buying tools before defining use cases, and failing to secure buy-in from operating partners.

Mistake #1: Assuming “AI Will Fix Everything”

Out-of-the-box AI tools achieve 70-75% accuracy. The remaining 25% requires human expertise.

Real Failure: A $2.8B private equity firm purchased an AI contract review platform for $80K annually. In a healthcare acquisition involving 3,400 contracts, 25.4% of AI flags were false positives, and one genuine $2.1 million penalty clause was missed entirely.

The Fix: Implement human-in-the-loop validation for private equity data analytics. Use AI to narrow 10,000 documents to 500 requiring expert review, achieving 99% accuracy while reducing manpower by 40%.

Mistake #2: Ignoring Unstructured Data

80% of valuable PE data is unstructured, including board presentations, management memos, email threads, and customer reviews.

Real Failure: A $1.9B industrial fund built a $450K Snowflake warehouse for financial metrics only, then spent another $280K adding unstructured data capabilities six months later.

Mistake #3: Buying Tools Before Defining Use Cases

Real Failure: A $3.5B fund spent $600K implementing 47 Tableau dashboards. Nine months later: 38 dashboards had zero views, 6 were viewed only by the data team, and 3 were actively used by operating partners. They spent $600K to get $120K worth of value.

The Fix: Start with use case definition workshops. Interview key users, document their top 10 recurring questions, and build ONLY the data analytics in private equity capabilities needed to answer those questions.

Mistake #4: Not Getting Operating Partner Buy-In

Real Failure: A $2.6B consumer goods fund hired a 3-person data science team ($750K annually) and built predictive models. Operating partners never used them because they didn’t understand how they worked, didn’t trust machine predictions, and weren’t involved in defining requirements. Total wasted investment: $1.1M.

The Fix: Involve operating partners from Day 1. Pilot with 1-2 friendly champions. Share early wins publicly. Train on “how to ask good questions,” not “how the technology works.”

Cost Reality Check: What Should Your Fund Budget?

| Fund AUM | Year 1 Investment | Annual Ongoing | ROI Timeline | Break-Even Scenario |

|---|---|---|---|---|

| $500M-$1B | $250K-$400K | $150K-$250K | 12-18 months | Find 1-2 operational improvements worth $500K+ |

| $1B-$3B | $400K-$700K | $250K-$450K | 9-15 months | Improve 1 exit timing by 2 quarters (worth $2-5M) |

| $3B-$10B | $700K-$1.2M | $450K-$800K | 6-12 months | Win 1 additional deal OR identify $3-5M in improvements |

| $10B+ | $1.2M-$2.5M | $800K-$1.5M | 6-9 months | Achieve 0.1-0.2x MOIC improvement ($50M-$200M) |

Comparison: Traditional vs. Modern PE Data Operations

| Dimension | Traditional | Modern Data Intelligence | Improvement |

|---|---|---|---|

| Storage | Fragmented Excel files | Unified data lakehouse | 90% faster reporting |

| Portfolio Reporting | Manual quarterly reports, 3-5 days | Automated daily dashboards | 95% time reduction |

| Due Diligence | 6-8 weeks manual review | 1-2 weeks with AI | 70% faster |

| Accuracy | 70-75% (human fatigue) | 99% (AI + human validation) | 30% fewer surprises |

| Data Sharing | Manual Excel exports | Zero-copy sharing | Eliminates version chaos |

| Governance | Per-company policies, 40+ hour audit prep | Centralized Unity Catalog, 4-hour prep | 90% faster compliance |

| Analytics Access | SQL analysts only | Self-service for all users | 60-70% fewer bottlenecks |

| Exit Timing | Experience-based intuition | ML predictive models | 0.3-0.5x MOIC improvement |

Conclusion: The Data Imperative Is Now, Not Later

The PE landscape has fundamentally split: private equity firms using data to make faster, better decisions, and firms watching their performance gap widen.

The numbers are undeniable:

- 17% return premium for data-driven strategies

- $2-5M annual cost of poor portfolio visibility for mid-market funds

- 0.3-0.5x MOIC improvement from predictive exit modeling

- 70% reduction in due diligence time using AI-augmented workflows

If you’re a GP or fund CFO, ask yourself:

- Can you answer any LP question about portfolio performance in under 24 hours?

- Do you know which portfolio companies are at operational risk before the quarterly board call?

- Can your team analyze 10,000 due diligence documents in 72 hours instead of 6 weeks?

If the answer to any of these is no, you’re not competing on a level playing field in private equity analytics.

With cloud-based lakehouses and AI-powered analytics, mid-market private equity firms can implement enterprise-grade capabilities in 6-12 months for $300K-$600K in Year 1.

Our expertise spans the broader financial services data analytics landscape, from wealth management and banking to private equity and investment funds, enabling us to deliver industry-specific insights that drive measurable portfolio outcomes.