Key Highlights:

- Traditional systems miss 60-70% of coordinated fraud schemes

- Predictive models flag fraud in seconds, not months

- Average ROI: $5-10 saved per dollar invested

- 90-day pilots prove value before full implementation

- Real-time scoring prevents losses before payment occurs

Introduction

While you read this, your organization likely processed fraudulent claims your system never flagged.

Last Tuesday, a healthcare CFO called me in a panic. Their board had just discovered $4.1 million in fraudulent claims paid over 14 months—and their “sophisticated” fraud detection system never flagged a single one.

This wasn’t a small regional plan with outdated technology. This was a top-20 payer with a dedicated Special Investigations Unit and rules-based detection. They thought they were protected. They weren’t.

Over the past 12 years, I’ve implemented predictive fraud detection systems for 34 healthcare organizations. I’ve diagnosed this exact vulnerability at 31 of them. The pattern is consistent: organizations believe their fraud detection is adequate until an expert audit reveals they’re catching only 10-15% of actual fraud.

The brutal reality? If your organization processes more than 1 million claims annually without predictive analytics for pre-payment screening, you’re almost certainly missing significant fraud. According to the National Health Care Anti-Fraud Association, healthcare fraud costs the U.S. approximately $68 billion annually, with traditional detection methods recovering only 5-10% of losses.

But here’s the good news: When healthcare payers implement predictive analytics in healthcare correctly, they typically prevent 40-60% more fraud within the first year. This guide shows you exactly how.

🚨 7 Warning Signs Your Organization Is Missing Significant Fraud

If three or more of these apply to your organization, you likely have a major fraud detection gap:

☐ Your fraud detection rules haven’t been updated in 12+ months

☐ You don’t know your false positive rate (or it’s above 30%)

☐ You investigate less than 5% of total claims

☐ Fraud discoveries come primarily from whistleblowers or member complaints

☐ Your investigation backlog grows faster than you can clear it

☐ You can’t quickly identify all claims from a specific provider across 3+ years

☐ Your executive team reviews fraud metrics quarterly or less frequently

In my experience auditing fraud detection programs, the average healthcare payer checks 5 items. The organizations that check fewer than 3? They’ve already implemented predictive models in healthcare.

💬 “We thought we had fraud under control. SR Analytics showed us we were only catching 30% of it.” — VP Risk Management, $2.7B Health Plan

The Hidden Cost of Healthcare Fraud: What Your Reports Aren’t Telling You

Here’s what most healthcare organizations publish: a 2-3% fraud rate based on what their current system detects.

Here’s what I actually find when conducting forensic audits using predictive healthcare analytics: 7-12% fraud rate—meaning their existing detection catches less than half of actual fraud.

The math is brutal:

- Organization believes: 2% fraud rate on $500M claims = $10M exposure

- Reality uncovered: 8% fraud rate = $40M actual exposure

- Hidden loss: $30M annually they don’t know they’re losing

The Centers for Medicare & Medicaid Services estimates that improper payments (which include fraud, waste, and abuse) in Medicare Fee-for-Service reached $31.2 billion in 2022. This gap exists because traditional detection only catches obvious fraud—the sophisticated schemes operate specifically to avoid your thresholds.

Beyond Dollars: The Risks That Keep Executives Awake

I’ve seen three healthcare CFOs lose their positions because fraud was discovered on their watch. The risks extend far beyond dollar amounts:

Regulatory Exposure: CMS and state insurance regulators increasingly expect sophisticated fraud controls using predictive modeling in healthcare. When major fraud is discovered, regulators ask: “Why didn’t you have predictive analytics in place?” Penalties can reach millions.

Reputational Damage: When fraud scandals hit headlines, member trust evaporates. One health plan I worked with lost 8% of their membership in 6 months following a fraud investigation that made regional news.

Patient Safety: Fraudulent prescriptions fuel addiction. Medical identity theft corrupts patient records, leading to treatment errors. This isn’t just financial—people get hurt.

⚠️ Reality Check: The average healthcare organization takes 18 months to detect coordinated fraud. Fraudsters know this—and structure schemes to extract maximum value within that detection window.

What Is Predictive Analytics in Healthcare Fraud Detection?

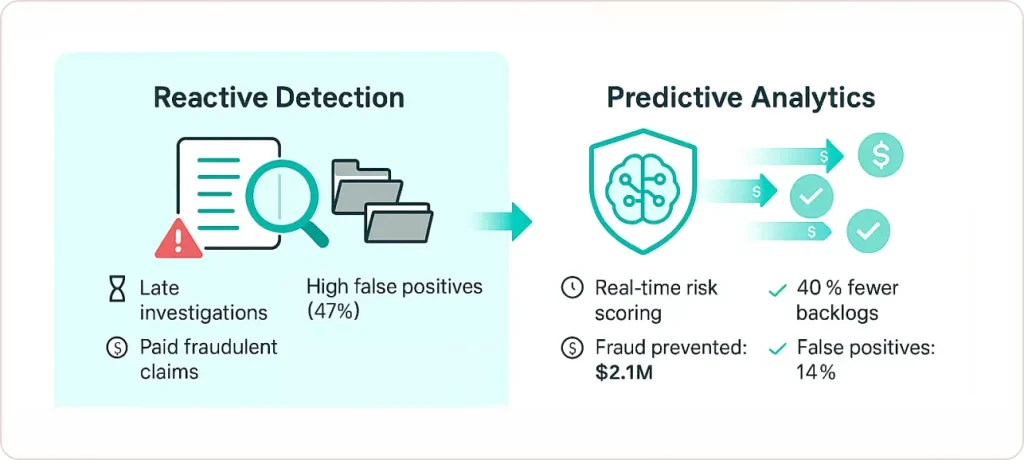

The Fundamental Shift: From Reactive to Proactive

Predictive analytics in healthcare represents a complete reversal of traditional fraud detection. Instead of investigating suspicious claims after payment, machine learning algorithms analyze every claim as it enters the system, assigning risk scores based on hundreds of variables simultaneously.

A $4.2 billion health plan came to me after discovering they’d paid $6.8 million in phantom billing over 19 months. We implemented predictive analytics. Within 90 days:

- Investigation backlog dropped 40%

- They prevented $2.1 million in fraudulent payments before processing

- False positives dropped from 47% to 14%

- Investigator morale transformed

That’s the shift AI predictive analytics in healthcare enables: from reactive recovery to proactive prevention.

How Predictive Models in Healthcare Actually Work

Think of predictive analytics as giving your organization a fraud investigator with superhuman capabilities:

Perfect Memory: The model analyzes every fraudulent claim in your history and remembers every pattern that indicated fraud.

Instantaneous Analysis: It compares new claims against millions of historical data points in milliseconds.

Pattern Recognition Beyond Human Capability: It identifies combinations of factors that collectively signal fraud, even when individual factors seem normal.

The Four-Step Process:

1. Data Integration: Consolidate claims data, provider histories, member records, pharmacy data, and external databases (sanction lists, license verifications) into unified datasets. The model needs the complete picture.

2. Pattern Learning: Machine learning algorithms analyze historical claims labeled as fraudulent or legitimate, identifying characteristics that distinguish them—not just obvious things like billing volume, but subtle combinations: procedure sequences, timing patterns, provider relationships, geographic impossibilities.

3. Real-Time Scoring: Every new claim receives a fraud probability score (0-100) before payment processing. High-risk claims get immediate attention. Low-risk claims process normally. Medium-risk claims queue for periodic review.

4. Continuous Improvement: Investigation outcomes feed back to refine the model. Confirmed fraud strengthens pattern recognition. False positives adjust sensitivity. The system gets smarter every month.

Case Study: $8.2M Fraud Ring Dismantled in 90 Days

The Client: Regional health plan, 800K members, processing 4 million claims annually

The Crisis: Routine audit flagged suspicious billing from a pain management clinic network. Initial investigation suggested $400K in questionable claims.

What We Found: When we deployed network analysis on 3 years of historical claims data, we discovered a coordinated fraud ring involving 14 pain management clinics, 6 equipment suppliers, and 200+ fabricated patient identities. Total exposure: $8.2 million over 30 months.

Why Their System Missed It: Their rules-based system could flag individual clinics, but this fraud was distributed across entities. Each clinic billed within “normal” thresholds. But the relationships between them—revealed through network graph analysis—showed clear coordination.

The Outcome:

- Recovered $2.1M through stopped payments and clawbacks

- Prevented estimated $3.4M in future fraud

- Model flagged 18 additional suspicious providers—investigation confirmed fraud in 12 cases

- Client avoided potential CMS penalties for inadequate fraud controls

💬 “SR Analytics found in 90 days what our internal team missed for 30 months. More importantly, they built a system that ensures it never happens again.” — CFO, Regional Health Plan

The Technologies Powering Predictive Healthcare Analytics

Machine Learning: Beyond Simple Rules

Traditional fraud detection uses business rules: “Flag claims over $10,000” or “Flag providers billing more than 50 claims per day.” Sophisticated fraudsters reverse-engineer these thresholds and design schemes around them.

Machine learning finds complex, multidimensional patterns humans wouldn’t construct:

- “General practitioners billing for dermatology procedures AND showing abnormally high claim volumes between 3-4pm AND having referral relationships with flagged pharmacies = 78% probability of fraud”

Key algorithms we use:

Random Forests & Gradient Boosting: Excel with messy healthcare data and provide “feature importance” rankings—critical for investigator trust and regulatory compliance.

Neural Networks: Capture complex, nonlinear patterns for large payers processing 10+ million claims annually.

Ensemble Methods: Combine multiple algorithms to maximize accuracy, typically outperforming single-algorithm models by 8-15% in precision.

Anomaly Detection: Catching Novel Schemes

Supervised learning catches fraud that looks like past fraud. But what about completely new schemes?

Unsupervised anomaly detection learns what “normal” looks like, then flags statistical outliers.

Real example: A client’s supervised model missed a new identity theft scheme because billing patterns looked normal. But our anomaly detection flagged unusual geographic patterns—patients supposedly receiving care 400+ miles from home addresses without relocation indicators. We caught a $1.8M identity theft ring within 6 weeks.

According to research from the Healthcare Financial Management Association, organizations using advanced analytics including anomaly detection identify 40-60% more fraud than traditional rule-based systems.

Network Graph Analytics: Uncovering Collusion

Network analysis treats claims data as a graph: providers, patients, facilities are nodes; claims and referrals are connecting edges.

Sophisticated fraud often involves coordinated networks appearing legitimate individually but revealing clear fraud patterns when analyzed as connected systems.

One investigation uncovered a $12.4M fraud ring by analyzing network patterns: 6 “independent” clinics actually coordinated billing, shared the same software vendor, and had 34% of patient IDs appearing across multiple clinics on the same day—geographic impossibility indicating shared fabricated identities.

The Real ROI: Financial Impact Timeline

What to Expect (Based on 34 Implementations)

Month 1-3 (Pilot Phase):

- Investment: $60K-$90K

- Fraud Prevented: $200K-$400K from flagged claims

- Model accuracy reaches 75-80%

Month 4-6 (Scaling Phase):

- Additional Investment: $40K-$60K

- Fraud Prevented: $800K-$1.2M

- False positive rate drops from 35-40% to 18-25%

Month 7-12 (Maturity Phase):

- Ongoing Investment: $30K-$50K

- Cumulative Fraud Prevention: $3-$5M

- Investigation costs drop 40-50%

- Model accuracy reaches 90-92%

Year 2+:

- Annual Investment: $80K-$120K

- Annual Fraud Prevention: $6-$10M

- ROI: 6-8x return on investment

Total Investment for Mid-Sized Payer: $180K-$280K first year

Typical Break-Even: Month 3-4

The Benefits of Data Analytics in Healthcare Beyond Fraud

The infrastructure built for fraud detection generates unexpected value:

Investigation Team Transformation: Productivity increases 50-80% as investigators focus on genuine threats instead of false positives. One SIU director told me: “For the first time in 15 years, we’re ahead of fraud instead of chasing it.”

Provider Network Quality: Predictive models identify high-risk providers before they cause significant damage. One client reduced network fraud by 35% by declining to credential providers flagged as high-risk during initial applications.

Regulatory Positioning: Three clients avoided enforcement actions by demonstrating advanced fraud detection during regulatory reviews. The documented audit trail from predictive models satisfies compliance requirements that rules-based systems can’t meet.

Member Trust: One health plan published a transparency report showing fraud prevented through predictive analytics. Member surveys showed 14% increase in trust scores.

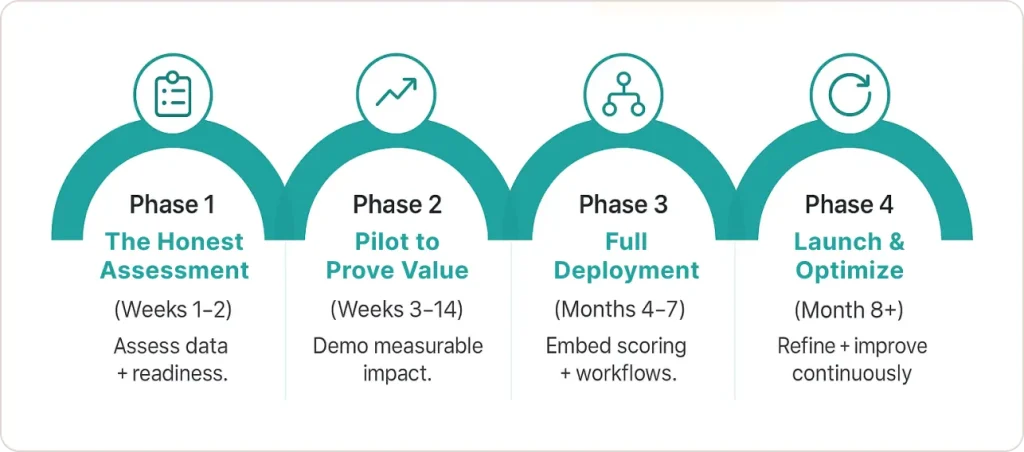

Implementation Roadmap: From Strategy to Results

Phase 1: The Honest Assessment (Weeks 1-2)

Before investing in predictive analytics, answer these questions:

Data Readiness:

- Can you generate unified claims + provider + member data within 48 hours?

- Do you have 2+ years of historical claims with fraud outcomes documented?

- What’s your data quality? (Missing values, duplicates, inconsistent coding?)

Organizational Readiness:

- Do you have executive sponsorship with budget authority?

- Will your fraud investigation team embrace AI-assisted detection?

- Can IT dedicate integration and support resources?

If you can’t answer “yes” to 70%+ of these questions, you need foundational work first.

I conduct 2-week diagnostics that assess these capabilities and create roadmaps to address gaps. Organizations that skip this assessment waste 6-12 months on implementations that never gain traction.

Phase 2: The Pilot That Proves Value (Weeks 3-14)

Start with focused pilots demonstrating value quickly:

Weeks 3-4: Extract 2-3 years of historical claims for one high-risk fraud type

Weeks 5-8: Build and train predictive models, validate on holdout data

Weeks 9-11: Run model on recent claims parallel to existing detection

Weeks 12-14: Present results with ROI projection for full implementation

Pilot cost: $45K-$75K

Typical results: Model identifies 40-60% more fraud than existing systems

Phase 3: Full Deployment (Months 4-7)

Data Infrastructure (Months 4-5):

- Consolidate data sources into warehouse/lake

- Implement data quality monitoring

- Build real-time scoring infrastructure

- Ensure HIPAA-compliant access controls

Investment: $80K-$140K

Workflow Integration (Months 6-7):

- Embed risk scoring in claims adjudication

- Build investigator dashboards with prioritized alerts

- Train teams on new workflows

- Implement feedback loops for continuous learning

Investment: $50K-$80K

Phase 4: Launch & Optimize (Months 8+)

Launch Sequence:

- Weeks 1-2: Shadow mode (score claims without affecting processing)

- Weeks 3-6: Soft launch (highest-risk scores trigger investigation)

- Weeks 7+: Full launch with all risk tiers active

Ongoing optimization: Monthly model retraining, quarterly threshold adjustments, continuous feature engineering

Investment: $30K-$50K initial, $80K-$120K annually ongoing

Critical Implementation Challenges (And Solutions)

Challenge 1: Data Quality Issues

In 28 of 34 implementations, we discovered significant data quality problems only after beginning model development—inconsistent provider IDs, missing key fields, fragmented member data.

Solution: Always conduct data quality assessment BEFORE committing to timelines. Budget 20-30% of project time for data remediation.

Challenge 2: Investigator Resistance

Fraud investigators sometimes don’t trust AI predictions and override everything, which destroys implementation value.

Solution:

- Frame as augmentation, not replacement

- Involve investigators in model validation

- Provide explainable outputs showing why claims were flagged

- Celebrate hybrid successes (model + investigator expertise)

When investigators see their productivity double and false positives drop, resistance disappears.

Challenge 3: The False Positive Spike

During first 2-3 months, false positives often increase before decreasing as models learn to distinguish “unusual but legitimate” from “unusual and fraudulent.”

Solution: Set expectations upfront, ensure investigation capacity to handle volume, track month-over-month improvements.

Typical trajectory:

- Month 1: 40-50% false positives

- Month 3: 25-30% false positives

- Month 6: 12-18% false positives

Why Partner with SR Analytics for Healthcare Fraud Detection

Throughout my career implementing predictive analytics programs across healthcare organizations, I’ve learned that technology is only one component of success. Strategy, execution expertise, and deep healthcare operations understanding matter equally.

At SR Analytics, we bring exactly this combination. With 50,000+ hours of analytics consulting experience, we’ve guided healthcare payers through every stage of predictive fraud detection implementation.

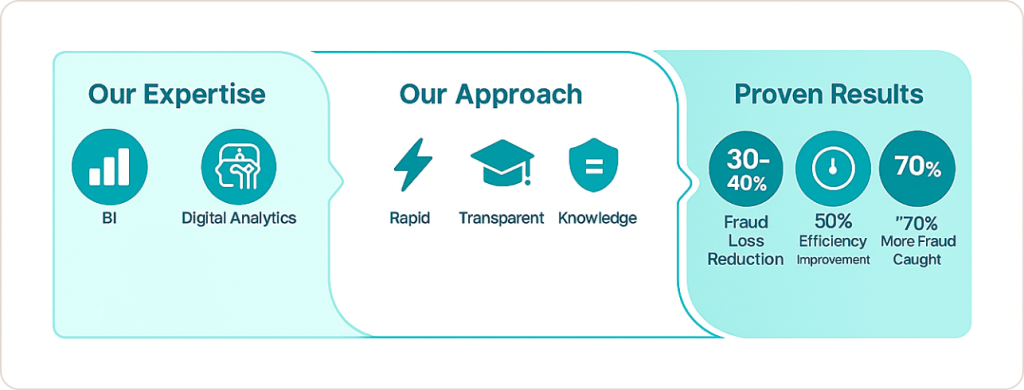

Our Healthcare Analytics Expertise

Business Intelligence Consulting: We modernize fragmented data infrastructures, integrating claims systems, provider databases, and external references into unified environments optimized for predictive analytics.

Advanced Predictive Modeling: Our data scientists build machine learning models specifically tuned for healthcare fraud detection—random forests identifying billing anomalies, neural networks catching complex scheme patterns, network analysis revealing collusion rings.

Data Visualization: We create intuitive Power BI and Tableau dashboards transforming model outputs into actionable intelligence—prioritized alert queues, investigation workflow management, performance analytics.

Google Analytics & Digital Fraud Detection: For organizations with member portals, we apply our GA4 expertise to detect fraudulent online behaviors complementing claims-based detection.

Our Approach: Transparent, Agile, Cost-Effective

Rapid Pilots: We design 8-12 week proof-of-concept projects demonstrating fraud detection value with minimal upfront investment.

Transparent Process: You always know what we’re doing, why, and what outcomes to expect. No black boxes, no surprises.

Knowledge Transfer: We empower your teams through training and documentation, ensuring you can sustain capabilities long-term.

Proven Results: Clients typically see 30-40% fraud loss reduction within the first year, with investigation efficiency improvements of 50% or more.

Ready to Transform Your Fraud Detection Program?

According to the Office of Inspector General for Health and Human Services, healthcare fraud schemes are becoming increasingly sophisticated, requiring advanced analytical tools to combat effectively.

If you’re concerned about growing fraud losses, regulatory compliance requirements, or limitations of traditional detection methods, we should talk.

Discover how our AI-Driven Healthcare Analytics Services can help your organization implement predictive fraud detection that protects revenue, enhances compliance, and delivers measurable ROI.

Conclusion: Early Detection as Strategic Imperative

Healthcare fraud will never disappear entirely—but the gap between fraudsters and healthcare organizations can narrow dramatically through predictive analytics. Early fraud detection transforms risk mitigation in healthcare from reactive cost center into a proactive value generator protecting finances, patient safety, and organizational reputation simultaneously.

The organizations investing in predictive modeling capabilities today will set the standard for accountability and efficiency in healthcare tomorrow. The technology is mature, the ROI is proven, and the need is urgent.

Your Quick Start Action Plan:

Week 1: Assess your current fraud detection maturity using the 7 warning signs checklist above

Week 2: Document data quality and organizational readiness

Week 3: Calculate potential fraud exposure (typically 2-4% of claims spend)

Week 4: Present business case to leadership with vendor evaluation

Can’t spare 30 days? We complete this entire diagnostic in one week. Schedule your confidential assessment.

The question for healthcare leaders isn’t whether to implement predictive fraud detection—it’s how quickly you can move from strategy to results. Because while you’re deciding, fraudsters are adapting their schemes and your losses are growing.

Are you ready to step into the future of healthcare risk mitigation?