Highlights

- Strategic execution tool connecting long-term vision to annual priorities with measurable outcomes

- Requires quarterly reviews to remain relevant as market conditions and business realities shift

- Differs from budgets by focusing on what you’ll accomplish (not just what you’ll spend) and why it matters

- Demands cross-functional input from sales, operations, product, and finance to avoid siloed planning failures

Have you ever watched a company with brilliant strategy completely miss their annual targets? Not because the strategy was wrong, but because nobody translated vision into executable plans.

I’ve seen it repeatedly. A leadership team sets ambitious goals in January, but by March, sales, operations, and product are working from completely different playbooks. Sales forecasted 30% growth. Operations budgeted for 15%. Product committed to features requiring 18 months, not 12.

The result? Misaligned spending, missed targets, and frustrated executives scrambling to explain what went wrong.

After working with finance teams for over a decade, I’ve learned the difference between companies that execute and those that don’t come down to how seriously they take AOP planning. Let me show you what an AOP is, why it matters in 2025, and exactly how to build one that drives results.

Define AOP (Annual Operating Plan): A comprehensive planning framework that details a company’s financial targets, operational goals, strategic initiatives, resource allocation, key performance indicators, and accountability structure for a single fiscal year. It serves as the execution roadmap for advancing multi-year strategic plans.

Quick Answer:

An Annual Operating Plan (AOP) is a comprehensive 12-month roadmap that translates your company’s strategic vision into specific financial targets, operational goals, and departmental initiatives, complete with budgets, KPIs, and accountability measures for the fiscal year ahead.

What is an Annual Operating Plan (AOP) in Finance?

An Annual Operating Plan (AOP) is a detailed 12-month plan that outlines your company’s financial targets, operational objectives, strategic initiatives, resource requirements, key performance indicators, and accountability structure, all designed to advance your multi-year strategic vision.

Think of it this way: Your strategic plan is your three-year destination. Your AOP is the specific route you’ll take this year, including fuel requirements, rest stops, alternate routes if you hit traffic, and exactly who’s responsible for navigating each leg of the journey.

The distinction matters because most companies confuse an AOP with a budget. A budget tells you how much money each department gets. An AOP tells you what they’re going to accomplish with it and how it advances company strategy.

Here’s what a comprehensive AOP typically includes:

- Financial projections: Revenue goals by segment, profit margins, cash flow forecasts

- Operational objectives: Customer acquisition targets, product launches, market expansion plans

- Strategic initiatives: Major projects advancing your multi-year strategy

- Resource allocation: Headcount plans, technology investments, capital expenditures

- Performance metrics: KPIs you’ll track monthly or quarterly

- Accountability framework: Who owns what, when deliverables are due

Why Companies Actually Need an AOP (The Real Reasons)

Alignment prevents expensive mistakes. According to Deloitte’s Q4 2024 CFO Signals survey, 42% of CFOs prioritize enterprise risk management in 2025, alongside cost optimization and digital transformation. Without an AOP, different departments make independent assumptions that don’t align. Sales teams’ plans for growth operations can’t be supported, marketing campaigns launch for products that aren’t ready, and nobody discovers the disconnect until it’s too late.

I recently worked with a healthcare company where three departments had each independently planned to hire data engineers, completely unaware they were competing for the same scarce talent pool in their city. We only caught this during AOP consolidation. By surfacing the conflict early, we adjusted hiring timelines, explored remote options, and cross-trained existing staff before it became a crisis.

Performance tracking becomes objective. With an AOP, quarterly business reviews focus on actual performance against established targets. Without one, these meetings devolve into storytelling sessions where everyone explains why their “missed targets” aren’t really missed if you think about them differently.

Mid-year pivots happen faster. When market conditions shift, and 71% of CEOs say they will evolve their supply chain approaches to mitigate risks according to Deloitte’s Spring 2025 CEO Survey, companies with scenario-planned AOPs can activate contingency plans within weeks. Those without spend months arguing about whether to cut costs, which costs to cut, and how to sequence changes.

Resource conflicts surface when they’re fixable. Building an AOP forces cross-functional conversation. When a product presents their roadmap and sales shows their forecast side-by-side, disconnects become obvious. Better to discover in December that your sales plan assumes a Q2 product launch that engineering has scheduled for Q4 than to find out in April.

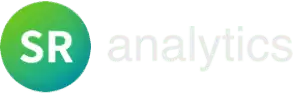

AOP vs. Budget vs. Strategic Plan: Critical Differences

Here’s where most companies get confused:

Strategic Plan (3-5 years): Your long-term vision, competitive positioning, and transformational goals. Answers: “Where are we going and why?”

Annual Operating Plan (12 months): Your execution roadmap for the year. Answers: “What will we accomplish this year to advance our strategy?” Includes specific initiatives with owners, timelines, and success criteria.

Budget (12 months): Your detailed financial forecast. Answers: “How much money goes where?” Line-item detail on revenues and expenses by department.

The relationship: Your strategic plan sets direction. Your AOP translates that direction into this year’s priorities. Your budget provides financial boundaries for executing the AOP.

I’ve reviewed countless “budgets” that were really just last year’s numbers plus 15%. No discussion of what changed in the market. No explanation of why marketing needs more budget or what they’ll do with it. No connection to strategy.

An AOP forces you to answer: If marketing gets that additional funding, what specific outcomes do we expect? How will we measure success? What happens if we don’t fund it? These questions create the accountability that budgets alone can’t provide.

Essential Components Every AOP Needs

After reviewing AOPs from dozens of companies, the strongest ones consistently include:

1. Executive Summary (1-2 pages)

Your board will read this. Maybe only this. Capture your top 3-5 priorities, critical market assumptions, major resource needs, and expected financial outcomes. Make every word count.

2. Strategic Objectives (3-5 Goals)

Cascade from your strategic plan. Make them specific: “Increase NPS from 38 to 50 through faster onboarding and 24/7 support” beats “improve customer satisfaction” every time.

3. Financial Projections

Revenue forecast by segment, expense budget by department with headcount assumptions, cash flow projections, key financial ratios. Build at least two scenarios (conservative and base case) so mid-year adjustments are less painful.

4. Departmental Operating Plans

Each function details their objectives, major initiatives, resource needs, key metrics, and dependencies on other teams. This is where cross-functional alignment actually happens.

For organizations in financial services, departmental plans need to account for regulatory requirements, compliance initiatives, and risk management frameworks that non-financial companies can often treat as secondary considerations.

5. Key Performance Indicators

Mix leading indicators (pipeline coverage, website traffic, product usage) with lagging indicators (revenue, churn, customer acquisition cost). If you’re implementing Power BI dashboards to track these metrics, make sure the KPIs in your AOP match what your dashboards will actually monitor.

6. Resource Requirements with Timing

Not “hire 12 people” but “add 2 SDRs in Q1, 3 customer success managers in Q2, 4 engineers in Q3.” Specificity drives accountability.

7. Risk Assessment and Contingencies

Document your top 3-4 risks with likelihood, potential impact, and response plans. Companies that had these scenarios documented in early 2020 could activate contingency plans in March. Those that hadn’t spent weeks arguing about what to do.

How to Build an AOP That Actually Works: The 7-Step Process

Step 1: Review Last Year’s Performance (2-4 Weeks Before Planning)

Before planning forward, look backward. Gather last year’s results, identify what drove outcomes (positive and negative), note what surprised you, and discuss what you’d do differently.

I facilitate retrospective sessions with leadership teams where we honestly assess: Which targets did we hit? Which did we miss, and why? What took longer than expected?

For instance, if your sales cycle extended from 90 to 120 days last year, you can’t build this year’s forecast assuming 90-day cycles. Use analytics approaches to identify patterns in historical performance. Descriptive analytics shows what happened, diagnostic analytics reveals why, and predictive analytics suggests what might happen again.

Step 2: Set Top-Line Objectives

Using your strategic plan as context, identify the 3-5 most critical outcomes for the coming year. Get executive alignment on these before proceeding. Everything else flows from these commitments.

Good objective: “Achieve $18M in revenue ($15M recurring, $3M services) representing 35% YoY growth through new customer acquisition in mid-market segment”

Bad objective: “Grow revenue”

Step 3: Gather Bottom-Up Departmental Plans

Ask each department head to submit their plan for achieving company objectives: forecasts, hiring needs, budget requirements, major initiatives, resource dependencies.

The first pass always reveals misalignments. Sales forecasts $18M but marketing’s lead generation plan supports $14M. Product commits to five major features but engineering capacity allows three.

Surface these conflicts explicitly. The whole point is catching disconnects in December, not discovering them in June.

Step 4: Build the Consolidated Financial Model

Translate departmental inputs into a complete P&L: revenue by segment, cost of goods sold, operating expenses by department, EBITDA projections, cash flow requirements.

This is where reality testing happens. If everyone’s plan adds up to $18M revenue but requires $22M in spending, you have choices: reduce spending, increase revenue targets, or secure additional funding.

For companies using demand forecasting techniques, this step benefits enormously from predictive models that account for seasonality, market trends, and historical patterns rather than simple linear projections.

Step 5: Model Multiple Scenarios

Your base case will be wrong. Build at least two additional scenarios:

Conservative case: Revenue 15-20% below base. What would you cut? In what order?

Stretch case: Revenue 15-20% above base. Could you execute? Where would you add resources? What constraints would you hit?

This scenario work pays dividends mid-year. You’ve already thought through response options instead of making pressure decisions.

Step 6: Document, Present, and Get Sign-Off

Compile everything into your AOP document. I typically create a full version (30-50 pages) with detailed plans and an executive summary (5-10 pages) for board presentation.

Present to leadership, incorporate feedback, get department heads to formally sign off on their commitments, and secure CEO and board approval.

This sign-off transforms the AOP from a planning exercise into an accountability framework.

Step 7: Execute, Monitor, and Adapt

The biggest mistake: treating the AOP as a January deliverable that gets filed until December.

Your AOP should drive monthly leadership meetings (review key metrics, discuss variances), quarterly business reviews (deep-dive on performance, reassess assumptions), and mid-year reforecasting (update assumptions based on H1 actuals).

Modern business intelligence solutions make this continuous monitoring possible by automating KPI tracking and variance analysis, freeing finance teams to focus on interpretation rather than data gathering.

This video provides practical insights into Annual Operating Plan (AOP) development, focusing on aligning financial planning with strategic goals, especially for startups and small businesses.

Expert Industry Perspective

“Scenario planning is something we’ve always done, but the current environment has caused us to really accelerate the way we do it… now, we’ve been running models and doing analysis almost daily.”

— David Chojnowski, Corporate Controller and Chief Accounting Officer, Walmart | Deloitte Program

Common AOP Failures (And How to Avoid Them)

Failure #1: Top-Down Targets With No Bottom-Up Validation

The CEO announces “We’re growing 50%!” without checking if the organization has capacity for 50% growth.

Solution: Start with aspirations but require validation. If there’s a gap, make it explicit. Then decide: Add resources to close the gap? Adjust the target? Accept the risk?

Failure #2: Planning in Silos

Each department builds their plan independently, leading to mismatched assumptions and duplicated investments.

Solution: Use cross-functional planning sessions where teams present to each other. Surface disconnects in real-time.

Failure #3: Building One Static Scenario

You create a single forecast, lock it in January, and refuse to revisit even when reality diverges.

Solution: Treat your AOP as a living document. Review quarterly, update assumptions when they change materially, reforecast H2 based on H1 actuals.

Failure #4: No Accountability Mechanism

The AOP gets approved, then nobody tracks whether departments deliver on commitments.

Solution: Tie compensation to AOP objectives. Track KPIs publicly. Discuss AOP progress in every leadership meeting.

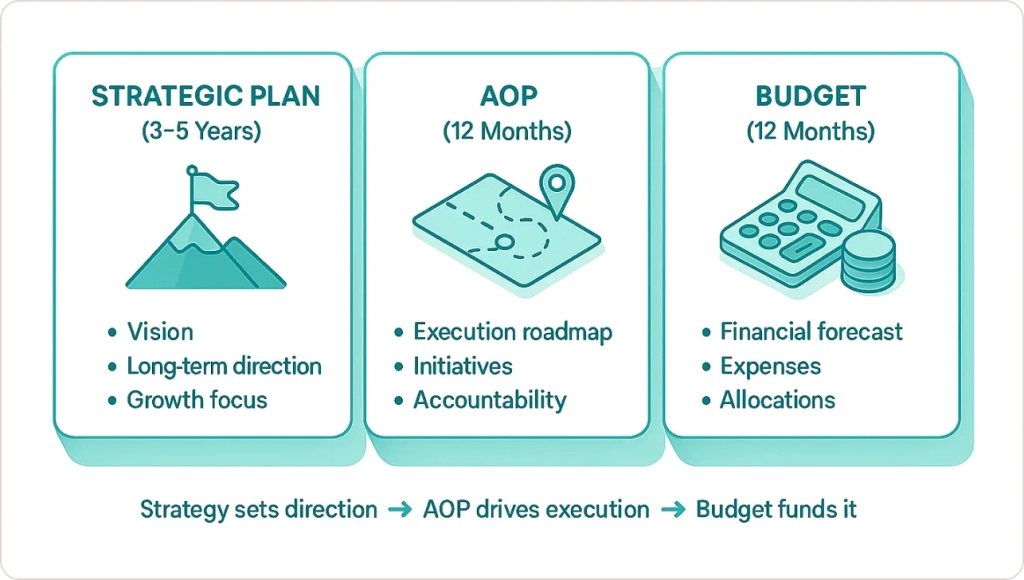

Best Practices from Companies That Execute Well

They involve stakeholders early. Building an AOP in isolation guarantees failure. Create shared ownership through cross-functional input.

They balance ambition with realism. Set stretch goals grounded in data. Fantasy numbers demoralize teams when they inevitably fall short.

They connect everything to strategy. Every initiative should answer: “How does this advance our strategic objectives?”

They leverage technology wisely. According to Deloitte’s CFO Signals survey, 40% of CFOs prioritize digital transformation of finance in 2025. Modern FP&A tools streamline AOP creation, enable scenario planning, and automate progress tracking.

They communicate relentlessly. Once finalized, socialize your AOP company-wide. Host town halls, create digestible one-pagers, explain how individual roles connect to objectives.

They treat it as living. Review monthly, revise quarterly, adjust when reality diverges. Rigidity in planning creates irrelevance.

Real-World Example: Manufacturing Company Transformation

Let me share a recent success story from a mid-market manufacturing client. According to Deloitte’s research on CFO priorities, more than half of CFOs are significantly more interested in undertaking acquisitions or mergers, with 44% allocating capital to new business investments, reflecting the strategic shift many companies are making in their planning processes.

This particular manufacturing company had been growing steadily at 12-15% annually but felt they were leaving opportunity on the table. They had departmental budgets but no unified operating plan.

We implemented their first comprehensive AOP in early 2024. The process revealed several game-changing insights:

Three departments had independently budgeted for different CRM systems (we consolidated to one platform, saving $180K). Their sales capacity could actually support 25% growth if marketing generated enough leads (previously, they’d assumed 15% was the ceiling). Operations needed to invest in automation earlier in the year to avoid Q4 capacity constraints that had plagued them for years.

By Q3, they’d achieved 23% year-over-year growth, well ahead of their historical trajectory. More importantly, the CEO told me: “For the first time in 10 years, I can confidently answer board questions about where we’re heading and how we’ll get there. The AOP gives us conviction and agility we never had before.”

That’s the power of planning done right.

Conclusion: Your Path to Better Execution

An Annual Operating Plan transforms strategic aspirations into executable reality. It’s the bridge between where you want to go and how you’ll actually get there.

The companies that consistently hit their targets share one characteristic: they treat AOP planning not as an annual ritual but as a continuous discipline. The AOP becomes their operating system, the shared language for priority-setting, resource allocation, and accountability.

Here’s what we’ve covered:

An AOP is more than a budget. It’s a comprehensive execution roadmap that includes financial targets, operational objectives, strategic initiatives, resource requirements, and accountability measures.

The planning process matters as much as the document. Cross-functional collaboration during AOP development surfaces misalignments before they become expensive problems.

Scenario planning is essential. Build multiple versions (conservative, base, stretch) so you’re prepared when reality diverges from your assumptions.

Execution requires discipline. Monthly reviews, quarterly deep-dives, and mid-year reforecasting keep your AOP relevant as conditions change.

Technology enables continuous planning. Modern analytics and BI tools automate tracking, freeing your team to focus on interpretation and decision-making rather than data gathering.

If you don’t have a formal AOP, commit to building one for next year. If you have one gathering dust, recommit to making it your operational centerpiece. Start by gathering your leadership team to review this year’s performance honestly. Then identify your top 3-5 objectives for the coming year. Get specific. Get measurable. Get aligned.

The difference between companies that execute well and those that struggle isn’t a better strategy. It’s a better system for translating strategy into action. The Annual Operating Plan is that system.