Financial Analytics

Transform Financial Decision-Making, Optimize Revenue, Manage Costs, and Navigate Risks Strategically with AI-Powered Analytics and Solutions.

Why Finance Teams Are Making the Shift

Finance and accounting departments face mounting pressure to deliver faster, more accurate insights while managing data from an expanding ecosystem of systems. Traditional Excel-based workflows create bottlenecks that prevent finance from becoming a strategic partner in business growth.

- Time-Intensive Manual Processes: Finance teams spend up to 70% of their time on data preparation rather than analysis

- Disconnected Data Sources: Critical financial data locked in ERP systems, spreadsheets, and departmental tools

- Limited Forecasting Accuracy: Static models fail to incorporate real-time market conditions or operational changes

- Compliance Complexity: Manual processes increase risk of errors in regulatory reporting

- Scalability Constraints: Traditional methods break down as organizations grow or undergo M&A activity

Our Approach to Financial Analytics

Our approach combines deep financial domain expertise with modern data architecture and AI-powered analytics to transform how your organization makes financial decisions.

01. Financial Planning & Analysis (FP&A)

Automate budgeting, forecasting, and scenario planning processes to give leadership the insights they need to drive strategic decisions.

Key Capabilities:

- Automated budget consolidation across business units and departments

- Rolling forecasts with real-time data integration

- Multi-scenario planning and sensitivity analysis

- Variance analysis with automated root cause identification

- Cash flow forecasting and working capital optimization

Business Impact: Reduce planning cycles by 50-70% while improving forecast accuracy by 15-25%

02. Cost & Profitability Analytics

Gain deep visibility into cost drivers and profitability across products, customers, channels, and business units.

Key Capabilities:

- Product and customer profitability analysis

- Activity-based costing and cost allocation models

- Margin analysis and pricing optimization

- Operating expense management and trend analysis

- Revenue driver identification and optimization

Business Impact: Identify 10-15% in cost reduction opportunities and optimize pricing strategies to improve margins by 3-8%

03. Revenue Growth Management Complexity

Streamline financial close processes and deliver accurate, timely reporting to stakeholders at all levels.

Key Capabilities:

- Automated financial statement generation (P&L, Balance Sheet, Cash Flow)

- Multi-entity consolidation with intercompany eliminations

- Management reporting dashboards with drill-down capabilities

- Board-ready presentations and executive scorecards

- Regulatory and statutory reporting automation

Business Impact: Accelerate month-end close by 30-50% and reduce reporting errors by up to 90%

04. Compliance & Risk Analytics

Ensure regulatory compliance while proactively identifying and managing financial risks.

Key Capabilities:

- SOC 1/SOC 2 compliance reporting

- Audit trail automation and documentation

- Tax compliance reporting and analytics

- Regulatory reporting (SOX, GAAP, IFRS)

- Risk monitoring and early warning systems

Business Impact: Reduce audit preparation time by 60% and minimize compliance-related risks

05. AI-Powered Predictive Analytics

Leverage artificial intelligence and machine learning to predict future performance and identify opportunities before they’re obvious.

Key Capabilities:

- Revenue and cash flow forecasting using ML algorithms

- Anomaly detection for fraud prevention and error identification

- Predictive scenario modeling for strategic planning

- Natural language queries for self-service analytics

- Automated insights and recommendations

Business Impact: Improve forecast accuracy by 20-30% and surface insights 10x faster than traditional analysis

Unlock actionable financial insights today

Our Process

How we transform your financial analytics capabilities

1. Assessment & Strategy (2-4 weeks)

We begin by understanding your current state, pain points, and strategic objectives.

Deliverables:

- Current state assessment of data, systems, and processes

- Gap analysis and improvement roadmap

- Prioritized use case identification

- Technology architecture recommendations

- Project timeline and success metrics

2. Design & Build (6-12 weeks)

Our team designs and builds your custom financial analytics solution.

Deliverables:

- Data integration from source systems

- Data model and warehouse architecture

- Analytics dashboards and reports

- Automated workflows and alerts

- Quality assurance and testing

3. Deployment & Training (2-4 weeks)

We ensure your team is empowered to leverage the new capabilities.

Deliverables:

- Production deployment

- User training and documentation

- Change management support

- Knowledge transfer sessions

- Post-launch support plan

4. Optimization & Support (Ongoing)

Continuous improvement to maximize value and adapt to changing needs.

Deliverables:

- Performance monitoring and optimization

- New feature development

- Ongoing training and support

- Quarterly business reviews

- Technology updates and enhancements

Success stories

Convert.com, a leading A/B testing platform, partnered with SR Analytics to unify fragmented systems into a single BI layer. The new Google Looker + BigQuery solution delivered role-specific dashboards, automated consolidation, and real-time insights across Finance, Marketing, and Operations.

20 hrs/week

Saved through automated reporting

15%

Improvement in marketing conversion efficiency

Beast Insights, a SaaS analytics platform for subscription businesses, partnered with SR Analytics to deliver modern, embedded Power BI dashboards inside their platform. The new solution unified fragmented sales, profitability, and retention data while ensuring secure, scalable access for every client.

80%

Reduction in manual reporting effort

5-10%

Increase in client retention rates

Questco helped reduce repetitive employee queries and streamline Benefits Operations with an AI-powered chatbot integrated into Microsoft Teams.

Questco, a leading employee benefits administration provider, partnered with AI automation specialists to develop Beth, a no-code AI chatbot that empowers employees to self-serve benefits queries using SharePoint as a real-time knowledge base.

40%

Reduction in manual queries to Operations team

92%+

Query resolution rate with automated responses

A financial services provider helped users better manage personal finances by unifying fragmented data across multiple bank accounts and payment apps.

A financial services provider partnered with AI R&D teams to build a smart, AI-powered web application that brought together transaction data from PhonePe, ICICI, SBI, and Bank of Baroda into a unified dashboard with predictive insights.

50%

Reduction in manual effort for finance management

85%+

Accuracy in AI-powered transaction categorization

YTBuddy helped students, researchers, and professionals enhance learning efficiency and video accessibility.

YTBuddy, a privacy-first AI browser extension, partnered with AI R&D teams to revolutionize how users interact with YouTube content, improve learning workflows, and support knowledge discovery.

70%

Time saved finding insights in instructional videos

100% Local

All processing performed locally ensuring complete privacy

SR Analytics helped Awe Inspired enhance operational efficiency and inventory management.

Awe Inspired, a fast-growing fine jewelry brand, partnered with SR Analytics to streamline inventory management, improve operational visibility, and support continued business growth.

30%

Reduction in excess inventory

~0.5 FTE

Equivalent workload saved through automation

SR Analytics helped a leading e-commerce retailer reduce stockouts by 25% and enhance overall business efficiency.

Our client, a major player in outdoor recreation and fitness equipment, needed a unified approach to data analytics to streamline operations, optimize inventory, and improve marketing efficiency.

25%

Reduction in stockouts

15%

Increase in online sales

SR Analytics helped a leading e-learning platform improve KPI tracking and achieve a 6x ROI.

Our client, a California-based SaaS company offering online courses, partnered with SR Analytics to transition from intuition-based decision-making to data-driven strategies, optimizing growth and performance.

6x ROI

Increase in return on investment

Higher Retention

Improved course engagement and student satisfaction

SR Analytics helped Pinnacle Fund Services streamline investment analysis and reporting with a powerful Power BI solution.

Pinnacle Fund Services, a leading fund management firm, required a consolidated reporting solution to track key financial metrics, improve asset analysis, and enhance investor performance evaluations.

360° Insights

Unified view of fund performance metrics

15+ Reports

Detailed insights into fund health and investor performance

SR Analytics helped Lifepro Fitness enhance operational efficiency through data engineering and BI solutions.

Lifepro Fitness, a global fitness equipment retailer, required a scalable solution to centralize reporting, automate data workflows, and optimize decision-making.

20+ Hours Saved Weekly

Reduction in manual data consolidation efforts

18% ROI Boost

Improved marketing efficiency through unified analytics

SR Analytics helped BJJ Fanatics improve data tracking, optimize conversion rates, and streamline reporting across multiple brands.

BJJ Fanatics, a global platform for Brazilian Jiu-Jitsu enthusiasts, required a centralized analytics solution to enhance digital performance and e-commerce tracking.

12% Conversion Increase

Boosted e-commerce conversion rates

15+ Hours Saved Weekly

Automated reporting reduced manual effort

SR Analytics helped ‘47 Brand enhance digital insights, streamline reporting, and optimize e-commerce performance.

‘47 Brand, a global leader in lifestyle and sports apparel, required a centralized reporting solution to improve e-commerce funnel visibility and marketing analytics.

20 Hours Saved Monthly

Automated reporting reduced manual effort

SR Analytics helped a leading healthcare provider modernize its legacy system, improving operational efficiency and scalability.

The healthcare provider needed a modernized patient management system to reduce inefficiencies, enhance integration, and support future growth.

40% Downtime Reduction

Improved system reliability and accessibility

SR Analytics helped a global e-commerce leader migrate to Azure, ensuring peak performance and cost efficiency.

The client required a scalable cloud solution to manage high-traffic periods, reduce operational costs, and enhance customer experience.

99.9% Uptime

Ensured system reliability during peak demand

30% Faster Load Times

Enhanced customer experience and retention

SR Analytics helped a global e-commerce leader migrate to Azure, ensuring peak performance and cost efficiency.

The client required a scalable cloud solution to manage high-traffic periods, reduce operational costs, and enhance customer experience.

99.9% Uptime

Ensured system reliability during peak demand

30% Faster Load Times

Enhanced customer experience and retention

SR Analytics helped a major telecom provider reduce customer churn, optimize network performance, and improve decision-making through advanced data analytics.

The client required a data-driven strategy to retain customers, enhance network reliability, and streamline operations.

15% Churn Reduction

Proactive engagement helped retain at-risk customers

20% Network Improvement

Fewer complaints due to real-time optimizations

SR Analytics helped Precise Imaging enhance resource allocation, reduce patient wait times, and improve operational efficiency through AI-driven capacity planning.

Precise Imaging, a multi-facility radiology provider, needed a data-driven solution to balance patient demand across locations, minimize inefficiencies, and optimize resource utilization.

22% Increase

Improved facility utilization across locations

$500K+ Annual Savings

Operational cost reductions through optimized resource distribution

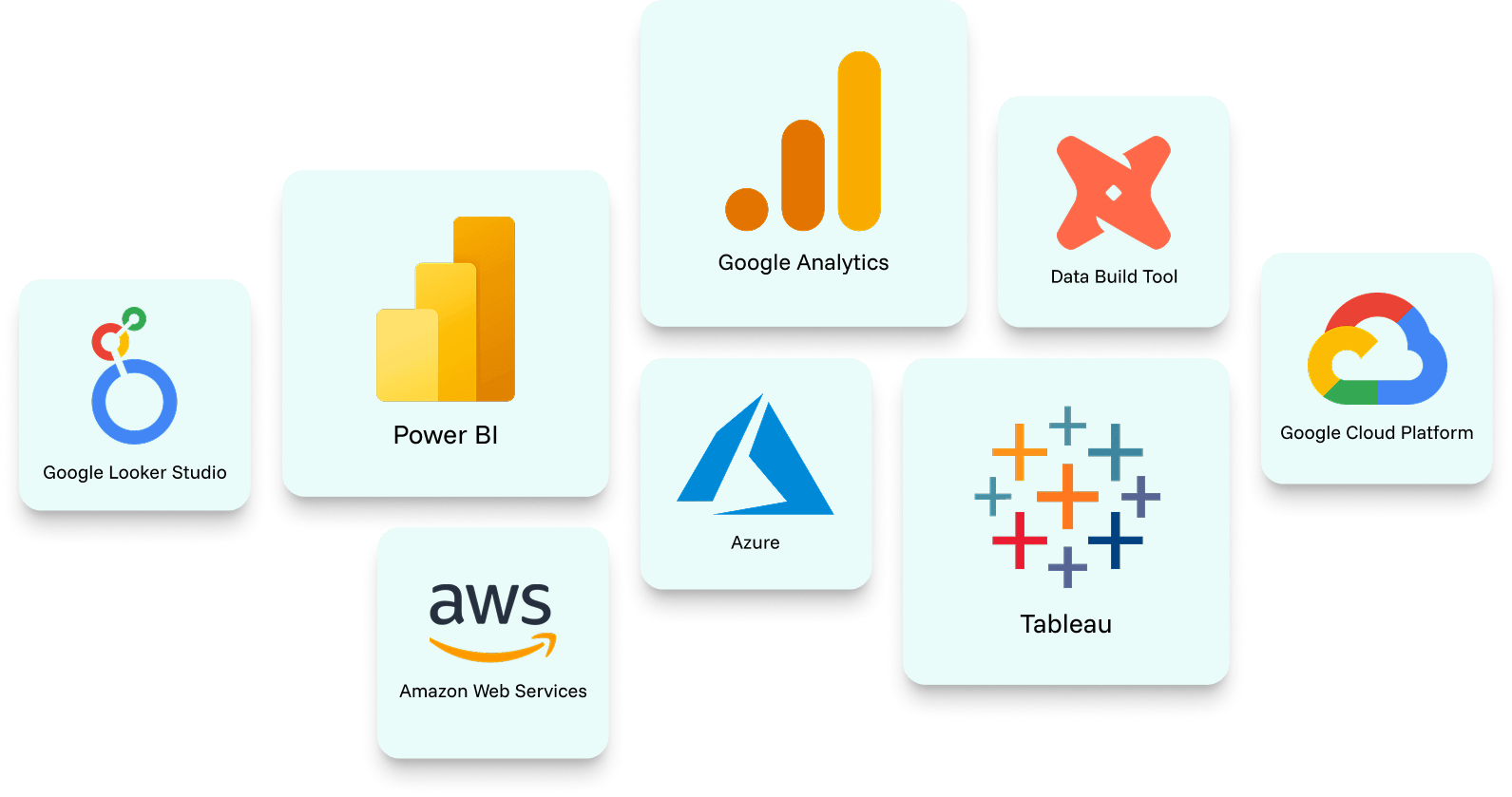

Our Technology Stack

We bring together the best of our partner network to help your business gain the competitive edge.

Why Choose SR Analytics?

Deep Financial Domain Expertise

Certified financial pros merged with data and analytics specialists for precise reporting, compliance, and insight-driven decisions.

Proven Implementation Methodology

We’ve successfully delivered 150+ financial analytics projects across industries, with 95% on-time and on-budget delivery.

Technology-Agnostic Approach

We recommend the best technology stack for your specific needs and budget, not a one-size-fits-all solution.

Focus on Business Outcomes

We measure success by business impact (faster close, improved accuracy, cost savings) not just technology deployment.

Flexible Engagement Models

From project-based implementations to ongoing managed services, we adapt to your resource constraints and preferences.

Customer testimonials

Don’t just take our word for it—hear from our customers.

SR Analytics transformed the way we manage data at Precise Imaging. Their custom Power BI dashboards gave us real-time visibility into billing, scheduling, and operations — helping us reduce no-shows and improve decision-making. They’re responsive, technically sharp, and truly understand our business needs.

Danny Rackow

CTO at Precise Imaging

SR Analytics successfully delivered all integrations and reports within the agreed timeline. Their ability to resolve issues and propose innovative ideas to simplify our processes has been invaluable. Highly recommended!

Ely

CEO, Consumer Products Company

SR Analytics has been instrumental in helping us identify and address challenges with precision, enabling us to implement effective solutions seamlessly. They went above and beyond, delivering the project with exceptional quality. We couldn’t be more satisfied with the results!

Sam Abrash

COO, Andromedia Group

Partnering with SR Analytics had an immediate and profoundly positive impact on our business. The insights from their dashboards led to significant product improvements. Their dedication and expertise made a remarkable difference!

Max Johnson

CEO, Awe Inspired

Latest Blogs

Unlock Financial Insights, Drive Informed Decisions

Unleash the power of your financial data to gain a clear understanding of your organization’s financial health. With our financial analytics services, you’ll access actionable insights that drive growth and profitability.

FAQs

Most implementations range from 8-16 weeks depending on scope and complexity. We typically see initial value within the first 30-45 days through quick-win use cases.

Our clients typically see 3-5x ROI within the first year through time savings, cost reductions, and improved decision-making. Specific ROI varies by use case and organization size.

No. We integrate with your existing ERP and financial systems to enhance their capabilities rather than replace them.

Data quality improvement is often part of our engagement. We assess data quality during discovery and include cleansing and governance processes in our solutions.

We have integration experience with all major ERP platforms (NetSuite, SAP, Oracle, Microsoft Dynamics, Sage Intacct) and many mid-market systems.

Yes. We offer flexible support and optimization packages to ensure continued value and adapt to your evolving needs.

Our Analytics Expert